The smart Trick of forex trading That No One is Discussing

A different strategy would be the "MACD histogram reversal". Traders try to find the MACD histogram to vary route. If it have been falling and afterwards started off increasing, traders would get. Conversely, if it were being soaring and then began to tumble, traders would market.

Grid Trading Grid trading relies on putting orders earlier mentioned and down below a set value, developing a grid with the orders. When utilized, it truly is most popular while in the forex marketplace.

Like a basic general guideline, If your MACD is beneath the zero line, never open any prolonged positions. Regardless if the bring about line crosses above the MACD line.

You may have very likely heard of the popular golden cross as being a predictor of key market place alterations. Effectively, In terms of the MACD trading strategy we don’t need to have these kinds of a substantial crossing to generate legitimate trade indicators.

From the daily viewpoint, we Have a look at An additional brief example in EUR/JPY demonstrated within the chart under. As you may see, the every day illustrations date farther back again for the reason that as soon as a clear trend has fashioned, it could possibly previous for years.

Having said that, to establish each time a inventory has entered the overbought/oversold territory, you are able to try to find a substantial length amongst the quick and sluggish lines of the indicator.

Prices of cryptocurrencies are very risky and could be impacted by exterior variables such as monetary, regulatory or political activities. Trading macd mt5 on margin enhances the money dangers.

This is actually the tighter and safer exit strategy. We exit the industry proper once the trigger line breaks the MACD in the other path.

In trending markets, traders can use MACD to determine possible get and offer factors. Once the MACD line crosses over the signal line throughout an uptrend, it is a bullish sign, and when it crosses underneath throughout a downtrend, it is a bearish sign.

Now, if you understand how to make a trading strategy, these strategies under can unquestionably serve as inspiration for developing your very own trading strategies!

This can be the outlines of the trading strategy that doesn't consist of crucial features like which markets and timeframes to trade and risk administration rules for example cutting losses more than a particular dimension etc.

Are there techniques to tell irrespective of whether there’s any genuine momentum driving the pattern? And Imagine if it commences pulling back—is there a means to time your acquire to match the stock’s predicted level of upward acceleration?

The MACD histogram is a chic visual illustration in the distinction between the MACD along with the signal line. If the MACD is earlier mentioned the signal line, the histogram are going to be previously mentioned the MACD's baseline. In the event the MACD is under the sign line, the histogram will probably be down below the MACD's baseline.

The MACD stock indicator relies on regardless of what time-frame you might be trading. Consequently, it’s usefulness or deficiency thereof has very little to accomplish with intraday trading as opposed to each day charts.

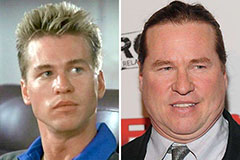

Val Kilmer Then & Now!

Val Kilmer Then & Now! Katie Holmes Then & Now!

Katie Holmes Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!